23 March 2023, London / Copenhagen

It’s likely that A.P. Moller – Maersk’s employees around the world pay a far higher rate of tax than the shipping multinational they work for, according to new analysis being released ahead of the Maersk AGM next week.

Researchers from the Centre for International Corporate Tax Accountability and Research (CICTAR) identify the extraordinary situation of the average worker in many countries where Maersk operates, paying a higher share of their income in tax than the Danish firm reports paying on its profits.

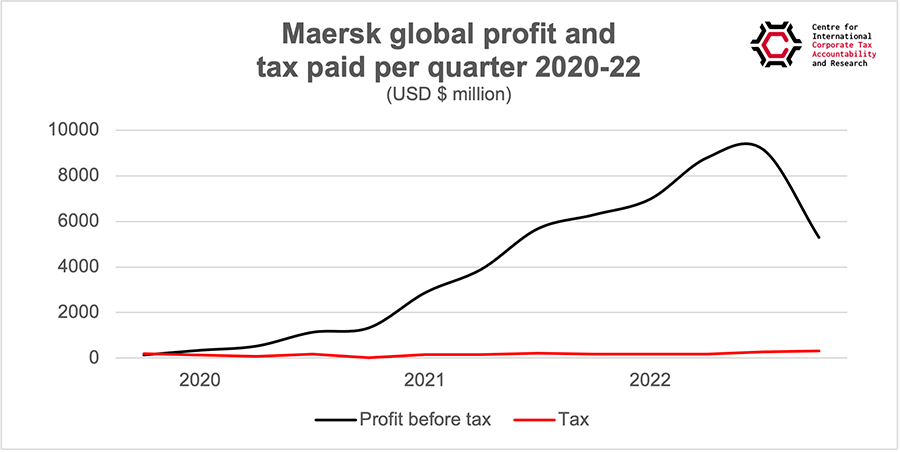

Globally, Maersk pre-tax profits totalled USD $49 billion across 2021 and 2022. But in 2021 it paid just 3.7 percent tax on its profits, and only 3 percent last year. The figure includes the tax it reported as paid in the 130 countries it operates.

Compare that with an average Danish worker who pays 39.1 percent income tax and social security contributions on their wages: a rate thirteen times higher than the rate paid by Maersk.

Key findings of ‘Do workers pay more tax than Maersk?’:

- A worker earning an average income in Denmark pays 13 times the rate Maersk pays

- Dutch workers are paying more than nine times the rate Maersk pays

- Argentinian workers are paying more than eight times the rate of tax that Maersk pays

- Australian workers on average pay 19.8 percent of their income in tax, more than six times Maersk’s tax rate

“Maersk is a Danish icon. And while we are proud of their commercial success, Maersk’s profits must not come at the expense of either workers or taxpayers – whether we are in Denmark or abroad,” said Karsten Kristensen, deputy chairman of the Transport Group at Danish union 3F.

“Maersk’s success needs to be a shared success, both with its workers and with society. It is concerning that these new figures suggest that the company is contributing at a lower rate of tax than workers do,” Kristensen said.

Kristensen said when companies don’t pay a fair share, “It means they are expecting other taxpayers, including workers, to foot the bill for essential public services like roads and ports through income taxes. This is a clear case of corporate double standards. We believe Danes expect more from Maersk.”

Danes miss out on $9.4 billion share of Maersk’s pandemic windfall

Maersk did extremely well through the pandemic and the corresponding supply chain crunch. The company’s global profits jumped considerably since 2020, multiplying more than 26 times in the two-year period, according to CICTAR’s brief.

But Danish taxpayers largely missed out on the good times. That is because, in contrast to other kinds of businesses which typically pay corporate tax rates in their home country on most or all of their profits, Maersk has paid a much lower ‘tonnage tax’ rate in home country Denmark instead.[1]

The researchers estimate that Danes forewent almost ten billion US dollars in tax revenue that its people could have otherwise benefited from, had Maersk’s profits been taxed at a rate closer to that paid by the typical worker:

Over the years 2020 to 2022, using the tonnage tax model rather than Denmark’s standard 22% company tax rate, Denmark has lost an estimated $9.4 billion in tax revenue.

“The pandemic has been a huge commercial opportunity for Maersk,” said Jason Ward, Principal Analyst at tax transparency centre CICTAR. “It managed to ship only slightly more in tonnes since 2020, but the company was able to extract substantially more profit from its business thanks to Denmark’s tonnage tax.”

The tonnage tax paid by the company rose from around USD $100 million per quarter in 2020 to around USD $200-250 million in 2022.

Ward said Maersk could do better in being more transparent in its tax conduct. “While they do provide some breakdown of total taxes paid in some locations, Maersk should follow the example of other Danish and European multinationals and report on all taxes paid and basic financial information in every country in which it operates,” he said.

Ward called for the company to prepare their accounts for publication according to Global Reporting Initiative (GRI) tax standard, which includes public country-by-country reporting. This will be required for all companies operating in Australia from July, including Maersk, once new rules come into force there.

ITF to challenge unfairness for workers, taxpayers at AGM

“Maersk Group’s shareholders will ask how the findings of this report fits with the company’s public commitments to sustainability,” said Kulsoom Jafri, Lead Campaigner at the International Transport Workers' Federation (ITF).

Jafri said there was a double standard when a multinational company like Maersk was banking super profits made during the pandemic, largely due to the hard work of employees, and paying a lower rate of tax than those workers were. “At the same time Maersk is putting its workers and suppliers under increasing pressure – especially in the global south.”

“Maersk only made super-profits because of the super-human efforts of seafarers, dockers, tug crew and truck drivers. For the Maersk Group employees who haven’t seen a pay rise in years, this news will be a slap in the face.”

Jafri said ITF would hand deliver its annual statement on Maersk’s ESG performance in person next week after the company shifted its AGM to online-only and barred shareholder groups, including unions, from reading out their statements themselves this year.

END

Notes:

- CICTAR’s brief Do workers pay more tax than Maersk? can be found in full here

References:

[1] ‘Since 2001, instead of levying standard corporate tax on shipping companies, Denmark has levied a tonnage tax that is determined by a fixed amount per net tonne.’ (Source: CICTAR, 2023)